| 12/2/2022 | Previous Day's Closing Price | Today Close | % CHANGE SINCE THE PRE-TRADING DAY CLOSE | CHANGE SINCE PRE-TRADING DAY CLOSE | |

| SPX | .INX | 4076.57 | 4071.7 | -0.12% | -4.87 |

| SPY | 407.37 | 406.91 | -0.11% | -0.46 | |

| QQQ | 293.72 | 292.55 | -0.40% | -1.17 | |

| TQQQ | 23.69 | 23.41 | -1.18% | -0.28 | |

| SQQQ | 41.25 | 41.79 | 1.31% | 0.54 | |

| SOXX | 385.24 | 380.89 | -1.13% | -4.35 | |

| SOXL | 13.5 | 13.03 | -3.48% | -0.47 | |

| SOXS | 30.74 | 31.79 | 3.42% | 1.05 | |

| DIA | 344.35 | 344.74 | 0.11% | 0.39 | |

| RUSSELL 2000 | IWM | 186.96 | 188.05 | 0.58% | 1.09 |

| DOW TRANSPORTATION | IYT | 232.41 | 231.51 | -0.39% | -0.9 |

| FINANCIAL | XLF | 36.1 | 35.93 | -0.47% | -0.17 |

| ENERGY | XLE | 90.85 | 90.31 | -0.59% | -0.54 |

| BIOTECH | XBI | 83.09 | 85.66 | 3.09% | 2.57 |

| CONSUMER STAPLE | XLP | 76.84 | 77.19 | 0.46% | 0.35 |

| HEALTH CARE | XLV | 139.42 | 139.78 | 0.26% | 0.36 |

| CONSUMER DISCRETIONARY | XLY | 146.15 | 145.96 | -0.13% | -0.19 |

| HOMEBUILDER | XHB | 63.06 | 62.63 | -0.68% | -0.43 |

| UTILITY | XLU | 71.37 | 71.03 | -0.48% | -0.34 |

| RETAIL | XRT | 66.37 | 67.02 | 0.98% | 0.65 |

| EMERGING MARKETS | SPEM | 34.3 | 34.51 | 0.61% | 0.21 |

| SOUTH KOREA INDEX | EWY | 60.31 | 59.44 | -1.44% | -0.87 |

| SOUTH KOREA 3X BULL | KORU | 9.07 | 8.65 | -4.63% | -0.42 |

| ARKK | 37.92 | 38.16 | 0.63% | 0.24 | |

| BITCOIN | /BTC | 16830 | 16925 | 0.56% | 95 |

| CRUDE OIL | /CL | 81.41 | 80.34 | -1.31% | -1.07 |

| GLD | 167.84 | 167.26 | -0.35% | -0.58 | |

| SLV | 20.98 | 21.29 | 1.48% | 0.31 | |

| GDX | 30.04 | 29.92 | -0.40% | -0.12 | |

| 3 MONTH | US3M | 4.33 | 4.34 | 0.23% | 0.01 |

| 2 YR | US2Y | 4.25 | 4.28 | 0.71% | 0.03 |

| 5 YR | FVX | 3.68 | 3.666 | -0.38% | -0.14 |

| 10 YR | TNX | 3.529 | 3.506 | -0.65% | -0.23 |

| 30 YR | TYX | 3.636 | 3.562 | -2.04% | -0.74 |

| 10Y3M (10yr 3m spread) | -0.8 | -0.8 | 0.00% | 0 | |

| 10Y2Y (10yr 2yr spread) | -0.72 | -0.72 | 0.00% | 0 | |

| T2107 (% stock above 200MA) | 49.11 | 49.31 | 0.41% | 0.2 | |

| T2108 (% stock above 40 MA) | 73.35 | 73.68 | 0.45% | 0.33 | |

| AAPL | 148.31 | 147.81 | -0.34% | -0.5 | |

| MSFT | 254.69 | 255.02 | 0.13% | 0.33 | |

| AMZN | 95.5 | 94.13 | -1.43% | -1.37 | |

| GOOGL | 100.99 | 100.44 | -0.54% | -0.55 | |

| TSLA | 194.7 | 194.86 | 0.08% | 0.16 | |

| NVDA | 171.35 | 168.76 | -1.51% | -2.59 |

*오늘 특이사항*

오늘의 시황 정리

Dow +34.87 at 34435.22, Nasdaq -20.95 at 11401.35, S&P -4.87 at 4072.12

It shaped up to be a pretty good day for the bulls, all things considered. The session started on a decidedly downbeat note, though, after market participants digested a generally positive November employment report.

The employment report featured stronger-than-expected nonfarm payrolls growth (263,000), higher-than-expected average hourly earnings growth (0.6%), and an in-line unemployment rate of 3.7% that held steady near a 50-year low.

Sellers stepped up their efforts on the heels of the release since this good news seemed likely to defer any eventual pivot by the Fed with its monetary policy, suggesting the target range for the fed funds rate will go higher yet and remain higher for longer, as Fed Chair Powell and other officials have suggested will be the case.

The Dow Jones Industrial Average, S&P 500, and Nasdaq were down 1.0%, 1.2%, and 1.6%, respectively, right out of the gate and the S&P 500 breached support at its 200-day moving average (4,046).

Buyers got back involved following that breach and brought the S&P 500 back above that key level where it vacillated for much of the day.

Things improved markedly, however, with about 90 minutes to go as the S&P 500 refused to drop back below its 200-day moving average and as Treasury yields continued with a sharp reversal from their post-employment report highs.

The 2-yr note yield, which hit 4.38% earlier, settled at 4.29%. The 10-yr note yield, which hit 3.60% earlier, settled at 3.51%. The U.S. Dollar Index, which was up as much as 0.8% following the employment report, ended down 0.2% at 104.53.

Notably, the Russell 2000 closed with a 0.6% gain and the Dow Jones Industrial Average made its way back above the unchanged line.

Roughly half of the 11 S&P 500 sectors closed in the green. Materials (+1.1%) enjoyed the biggest gain while energy (-0.6%) fell to the bottom of the pack.

- Dow Jones Industrial Average: -5.3% YTD

- S&P Midcap 400: -9.4% YTD

- Russell 2000: -15.7% YTD

- S&P 500: -14.6% YTD

- Nasdaq Composite: -26.7% YTD

Reviewing today's economic data:

- November nonfarm payrolls rose by 263,000 (Briefing.com consensus 200,000) following a revised 284,000 increase in October (from 261,000). Nonfarm private payrolls increased by 221,000 (Briefing.com consensus 200,000) following a revised 248,000 increase in October (from 233,000).

- Average hourly earnings were up 0.6% (Briefing.com consensus 0.3%) versus a prior revised 0.5% increase (from 0.4%).

- The unemployment rate was unchanged at 3.7%. The average workweek fell to 34.4 hours from 34.5 in October.

- The key takeaway from the report is mixed. The report itself is good news from an economic standpoint, yet the market sees it as bad news, thinking it will push out any eventual pivot by the Fed with its monetary policy. In brief, it is a report that screams higher for longer with respect to the target range for the fed funds rate.

Looking ahead to Monday, market participants will receive the following economic data:

- 9:45 a.m. ET: November IHS Markit Services PMI - Final (prior 46.1)

- 10:00 a.m. ET: October Factory Orders (prior 0.3%)

- 10:00 a.m. ET: November ISM Non-Manufacturing Index (prior 46.6%)

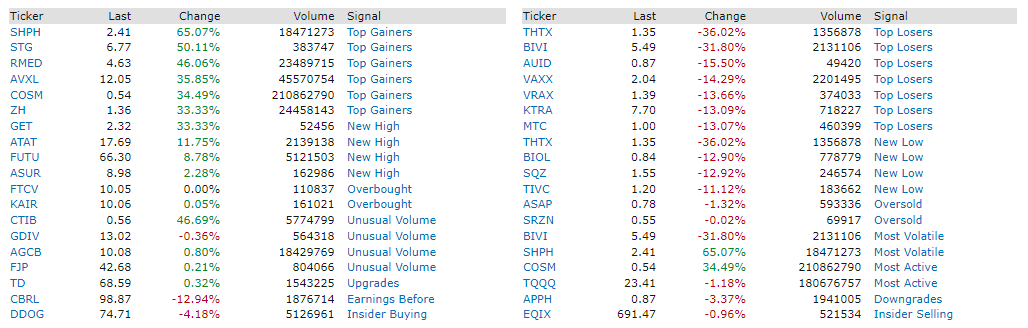

특이 종목 변동 사항

거래량 10밀리언 이상 & Watch List

'미국주식 투자 > 데일리 시황 정리' 카테고리의 다른 글

| 12/6/2022 (0) | 2022.12.07 |

|---|---|

| 12/5/2022 (0) | 2022.12.06 |

| 12/1/2022 (0) | 2022.12.02 |

| 11/30/2022 (0) | 2022.12.01 |

| 11/29/2022 (0) | 2022.11.30 |

댓글